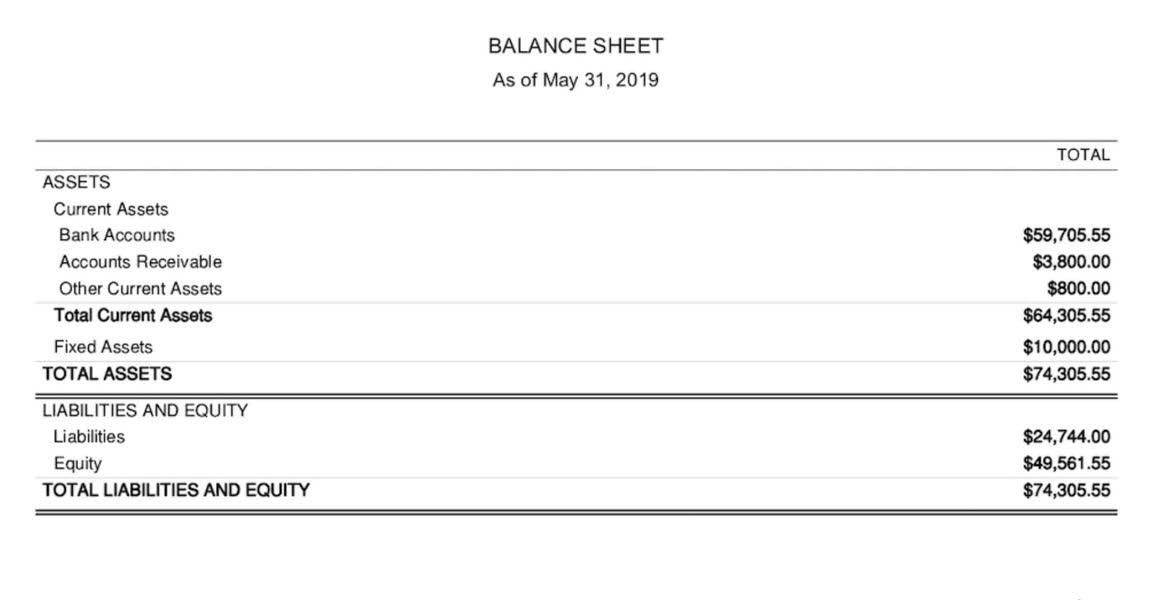

In this way, the number of both issued and outstanding shares is reduced. Weighted average shares outstanding is the process of weighting every number of common stock to reflect how much time they were in effect. The image below shows a section of Apple’s (AAPL 1.52%) balance sheet from 2016 through 2020.

Book Value of Equity vs. Market Value of Equity: What is the Difference?

In general, stocks with low floats will experience more volatility than those with large floats. Other companies may explicitly list their outstanding shares as a line item in the equity section of their balance sheet. The shares companies issue are known as authorized shares, which are the maximum number of shares they are lawfully permitted to make available to investors. Authorized share is the maximum number of shares a common issue mandated during a company’s public offering. Due to their voting rights, they have control of the company’s affairs and can vote and how to calculate common stock outstanding elect the directors. If the entity has good performance, these shareholders get very high returns, which comes with a huge risk loss if the stock price goes down or the company goes bankrupt.

What is the role of treasury shares in calculating outstanding shares?

These shares are held in the corporation’s “treasury” rather than in circulation and are therefore excluded from the number of outstanding shares. Outstanding shares refers to shares that are currently in circulation. It includes shares held by the general public and restricted shares that are owned by company officers and insiders.

- As for the “Treasury Stock” line item, the roll-forward calculation consists of one single outflow – the repurchases made in the current period.

- If we rearrange the balance sheet equation, we’re left with the shareholders’ equity formula.

- But the supply of shares in the market can have a bearing on trading dynamics.

- Issued shares are those given out in exchange for money to investors or as compensation for work or supplies one does or provides for the company to employees and suppliers.

- A stockholder owns 1% of the company if they possess 1,000 ordinary shares.

- A company’s outstanding shares, the total shares held by shareholders excluding treasury stock, can fluctuate due to various factors.

How are weighted average shares outstanding different than basic shares outstanding?

Common stockholders have voting rights and are entitled to get dividend on their holdings. Outstanding shares provide insights into a company’s size, ownership structure, and market capitalization. The number of outstanding shares affects several key financial metrics and ratios, including earnings per share (EPS) and price-to-earnings (P/E) ratio. A company’s number https://www.bookstime.com/ of issued shares includes any shares the company has bought back and now holds in its treasury. The term “float” refers to the number of shares available to be traded by the public and excludes any shares held by company executives or the company’s treasury. Total outstanding shares represent the number of shares of a company’s stock that are currently held by all its shareholders, including institutional investors, company insiders, and the public.

What Is the Formula for Calculating Earnings per Share (EPS)?

The earnings per share figure is especially meaningful when investors look at both historical and future EPS figures for the same company, or when they compare EPS for companies within the same industry. Authorized shares are the maximum number of shares a company can issue, as specified in its corporate charter. Outstanding shares are the shares that have been issued and are currently held by investors. Assume that Company A has 100 million shares outstanding and a trading price of $10.

How Do Stock Buybacks Impact Shareholders Equity?

Investors can use the number of outstanding shares https://www.instagram.com/bookstime_inc to evaluate a company’s financial health and performance. It helps in calculating key financial ratios and understanding the company’s ownership distribution. Treasury shares are the portion of shares that a company keeps in its own treasury. These shares are not considered outstanding because they are not held by public or institutional investors.

Forward EPS

They also do not include preferred shares, which are stocks that do not carry shareholder voting rights, but do give their owners some ownership rights and pay a fixed dividend. If you want to understand how to make money trading stocks, it’s critical to understand the different kinds of shares that companies make available. Calculating the number of outstanding shares a company has can help you to understand what proportion of a company’s stock is held by its shareholders.